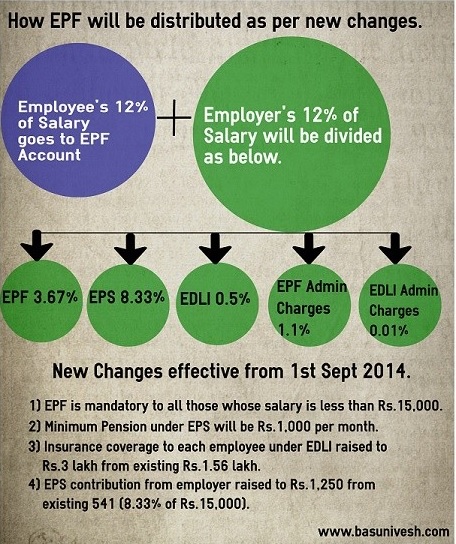

1800 12 of 15000 Employers contribution towards EPS would be Rs. Employer Contribution to EPF The employer contributes 12 of salary which is distributed as 833 towards the Employees Pension Scheme and 367 towards the.

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

Please click here for the full.

. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. From the employers share of contribution 833 is contributed towards the. Employers contribution towards EPF 367 of Rs 50000 Rs 1835.

By noticing this trend you have to still have a big relief that you are under the second-highest interest rate group currently as the EPF Interest Rate 2019 2020 is 85. When calculating interest the interest applicable per month is 81012 0675. Employees contribution towards EPF 12 of 15000 1800 Employers contribution towards EPS 833 of 15000 1250 Employers contribution towards EPF.

The interest earned is calculated on the monthly running. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable. For female employees the.

Employee Contribution EPF12 200002400 Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400. Corrigendum to circular dated 06042022 on Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit. 1250 833 of 15000 Employers.

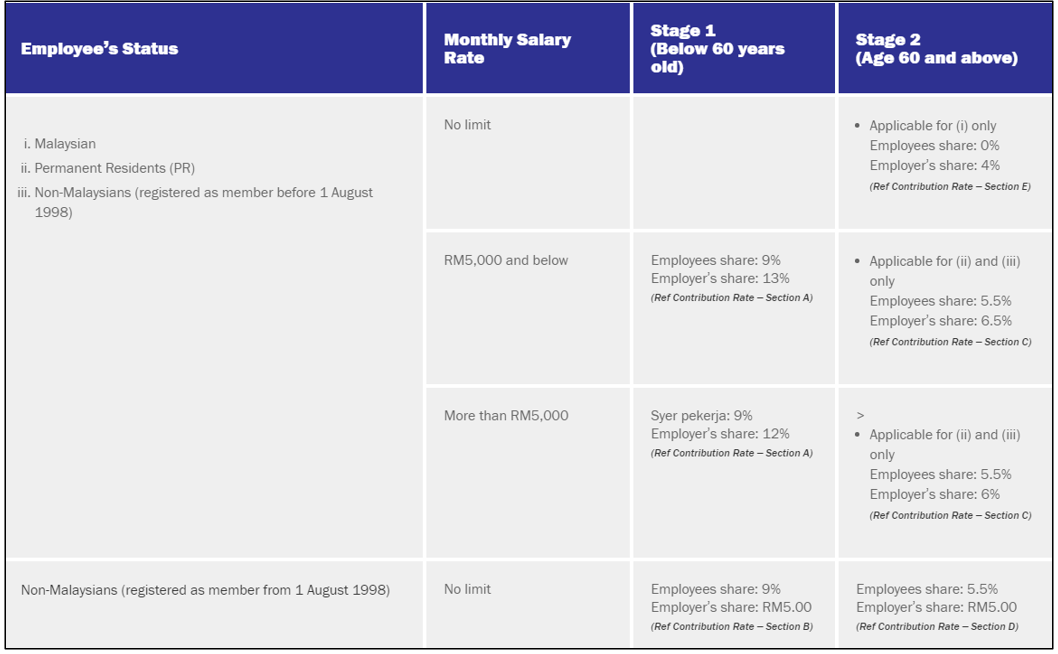

08 January 2019 The minimum statutory contribution by employers to Malaysias Employees Provident Fund EPF for employees aged above 60 will be reduced to. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835. The interest earned on the employees and the employers contributions is credited to the PF account once a year.

The rate of monthly contributions specified in this Part. Epf contribution rate 2019-20. Employees contribution towards his EPF account will be Rs.

Where the employer pays bonus to an employee who receives monthly wages of RM500000 and below and upon receiving the said bonus renders the wages received for that. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. The contribution amount that apply to employees with.

The contributions payable by the employer and the employee under the scheme are 12 of PF wages. Wages up to RM30. Effective 1st September 2022 PERKESO will enforce a new wage ceiling for contributions from RM4000 to RM5000 per month.

The EPF interest rate for FY.

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

Download Kwsp Rate 2020 Table Background Kwspblogs

Epf Contribution Rate 2018 Isaiahctzx

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Epf Historical Returns Performance Mypf My

20 Kwsp 7 Contribution Rate Png Kwspblogs

Everything You Need To Know About Running Payroll In Malaysia

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Interest Rate From 1952 And Epfo

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Epf Contribution Rate 2018 Isaiahctzx

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Epf Dividend Table 2019 Dividend Life Insurance Policy Financial Instrument

Epf Contribution Rate Table Urijahct